If we have sufficient skills in managing finances, such as in financial products and services, our standard of living can improve significantly because we are able to use them well. Wisely in Using Finances and Becoming Prosperous It also affects your financial wealth a little bit. In short, if we understand financial literacy well, it will not be difficult for us to choose a strategy and make the right decisions regarding our financial affairs.

This includes managing monthly cash flow, setting up emergency funds, insurance, and investing.

With qualified financial literacy, it will be easier for us to manage finances in such a way. The Importance of Studying Financial Literacyįinancial literacy has a number of good benefits for you, especially for future welfare. Especially for those of you who buy financial products such as stocks or bonds. Having a good understanding of risk can minimize losses and optimize the profits you can achieve.

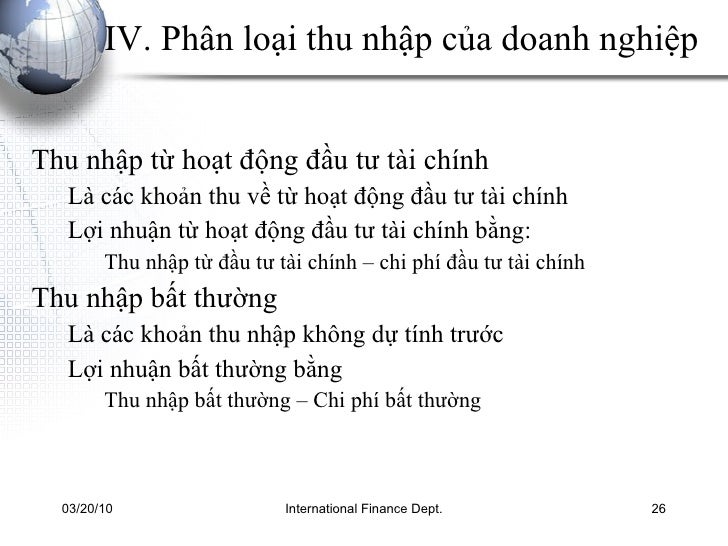

This can be overcome easily if someone has good risk management. Risk is a consequence that exists because of uncertainty. For example, the existing money is invested to buy stocks, P2P Lending (Peer to Peer), bonds, deposits, and much more. While investment is part of the savings allocated for things that produce goods or services. Savings is part of the funds that are not used for consumption activities. That is the activity of systematically collecting information related to credit at a bank or finance company and being able to manage it properly. How a person manages their finances. The better the understanding of financial literacy, the better the way that person manages their finances. For example, knowledge of liquidity, inflation, assets, simple interest, compound interest, time value, and others. Aspects of Financial Literacy According to Nababan dan Sadaliaīasic understanding of own financial literacy. For example, knowledge of investment risk, investment products such as stocks, bonds, mutual funds, and others. Have an understanding of investment and everything related to it. For example health insurance, life insurance, vehicle insurance, and so on. Understand basic information about insurance and its types. The second aspect includes knowledge of savings and loans. Understand basic knowledge or information about your own finances. Understanding of Basic Knowledge of Personal Finance Aspects of Financial Literacy According to Chen and Volpeġ. In addition to the 3 aspects described by OJK, there are also 2 other important aspects that were put forward by the experts. In accordance with the instrument of choice and existing conditions. This means that there is a sense of trust in the money that is channeled to be processed by a trusted financial institution or service. For example, taking into account risk, calculating interest, and others. Skills or skills indicate that the individual is able to apply the knowledge he has to manage finances. This means that an individual has adequate knowledge or information about financial service institutions, risks, rights and obligations of consumers, and others. Quoted from the Financial Services Authority, financial literacy has 3 important aspects. That is why one indicator of a country's progress is marked by public awareness of the importance of financial literacy. The existence of this awareness has a long-term effect that can maintain a stable, safe, and prosperous financial condition.įinancial literacy is not only important for individuals but also influences the economic progress of a country. Financial literacy is knowledge and skills in managing finances.

0 kommentar(er)

0 kommentar(er)